- #Quicken mint or personal capital for free

- #Quicken mint or personal capital how to

- #Quicken mint or personal capital software

If you’re going to bank online, you’re going to take some risk … that much is inevitable. While it’s great to critically examine the security of Personal Capital, in the real world it’s also helpful to put the risk in context. What happens if someone manages to hack into Yodlee?īut first, a little perspective is in order.

What happens if someone does manage to hack into my Personal Capital account?.How secure is my Personal Capital account?.So, based on the data-flow to and from the website, we can break this issue down into four basic questions: More on Yodlee in a moment, but that distinction is important for wrapping your head around the security of Personal Capital. Those are passed on to a third-party data aggregation service called Yodlee. It’s just a quick overview, but I do think it’s important, because we can use this as a roadmap to identify where vulnerabilities, if any, most likely exist, and what Personal Capital has done to protect against them.Īs you can see from the above diagram, Personal Capital does not actually hold your login credentials. Don’t worry this is not going to get very technical. The first step in finding out if we can trust Personal Capital is to understand an overview of the data-flow into the system.

#Quicken mint or personal capital how to

However, I do plan a deep-dive into Personal Capital in the coming weeks.) So the crucial question remains: “is Personal Capital safe?” How to Know if Personal Capital is Safe

#Quicken mint or personal capital software

(There’s much more to say about their software and services, but that’s beyond the purpose of this article.

#Quicken mint or personal capital for free

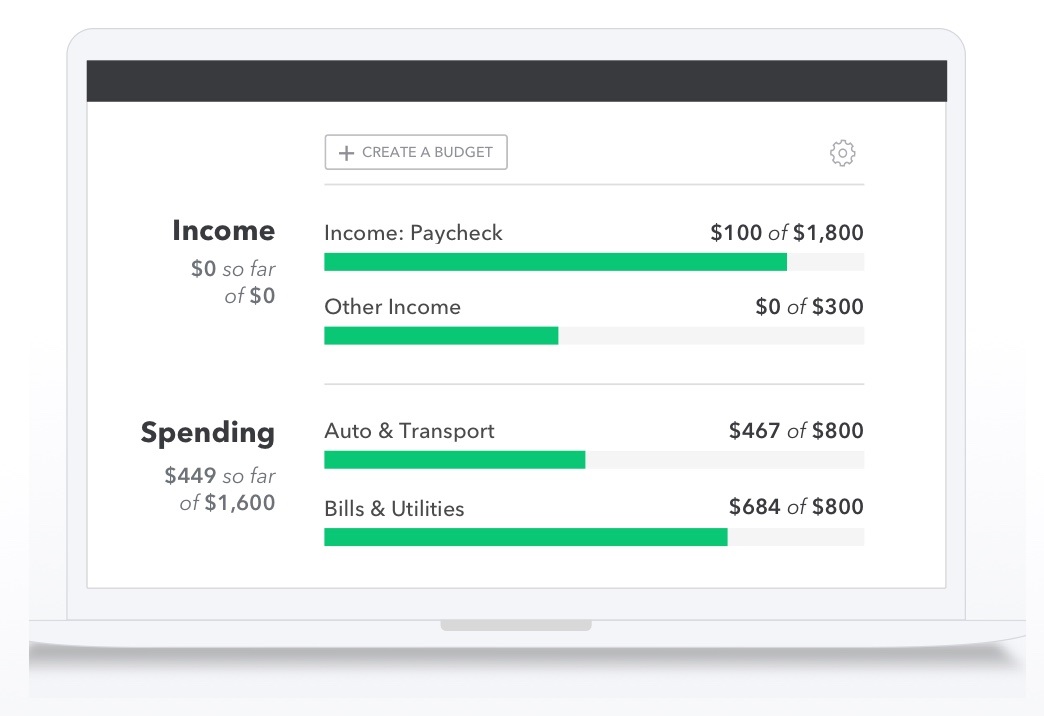

Personal Capital is a for-profit business, operating under a “freemium” model, where they give away their personal finance tools for free in exchange for the opportunity to offer their investment services. In fact, as of this writing, Personal Capital reports assets under management of over $8 billion. It’s been around since 2009, and has grown quite large in the last decade. Personal Capital is a website that collects and organizes all your financial information in one centralized place, including cash-flow, debt, investments, and net worth. Is it safe handing over all your online financial passwords to someone else? Is it worth the risk? So, ever since these systems first appeared about ten years ago, we’ve all been faced with the same question: To use them you have to entrust your login credentials into their hands. However, like everything in life, there are trade-offs to these convenient systems. Luckily, programs like, Personal Capital, and other cloud-based personal finance websites offer exactly that - a 100% automated, 360-degree, holistic view of your financial picture. And while online banking and bill-pay are convenient, in my opinion, having the ability to track my finances in one holistic system is just as vital to my long-term financial health.

0 kommentar(er)

0 kommentar(er)